In the business world, a good company is one that operates well on the inside before serving on the outside. But to operate well, you gotta make sure that your finances are in order as you go. And that’s where proper accounting practices come in. From the basic steps to more complicated tasks, accountants have a lot to do. And that’s when we pose the following question: In-house vs outsourced accounting, which is better for your company? Well, we’re gonna break the pros and cons of both now, and you can choose accordingly!

In-House vs Outsourced Accounting - Pros & Cons!

So, in the in-house vs outsourced accounting debate, we’re gonna leave it up to you to choose your preferred method. However, we’re not gonna leave you hanging, so here are the pros and cons of both:

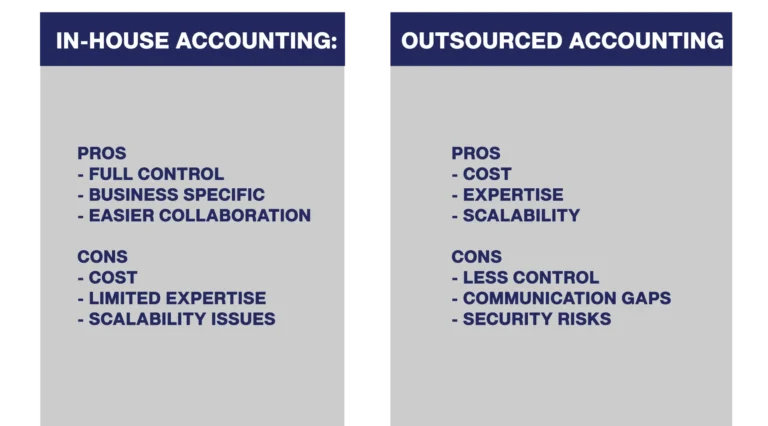

In-House Accounting

Pros

- Full control and direct access to your company’s financial data since no third-party is involved.

- In-house accounting is specifically and exclusively focused on your business. This means your company’s needs will be better met.

- Keeping accounting in-house makes communication with other departments easier.

Cons

- The expenses of having an in-house accounting team could be costly. This includes salaries, training, and general office/resource expenses.

- Since accounting is a broad department with many branches like tax compliance, VAT, and more, a small team might not have enough capacity or experience to cover it all.

- Scalability could be an issue if you go for in-house accounting, especially as your company grows. You see, hiring more accountants could be too expensive and pretty challenging time-wise.

Outsourced Accounting

Pros

- If you’re looking for a cost-effective solution, outsourcing could be the solution. After all, you will only pay for the services that you need.

- The expertise you will have access to by outsourcing is wider. That is especially true if you need specialists in different branches like taxes, financial strategies, etc…

- Outsourced accounting provides more flexibility, specifically when you need to scale up as your business grows.

Cons

- External firms will have control of your data as they will handle it. And this requires a certain amount of trust.

- Communication errors could happen within one company, let alone with a third party. This could lead to delays, especially if the firm you’re working with operates in a different time zone.

- A third party handling all your sensitive data could be a security risk. Hence why you need to choose your firm carefully.

In-House vs Outsourced Accounting - Which Type Should You Choose?

So, the choice is really up to your preferences and the size of the company when it comes to in-house vs outsourced accounting. For example, if the company is large and has a lot of financial needs, an in-house accounting team could be a better option. However, if you own an SME, outsourced accounting is the solution! Finally, many companies go for a hybrid solution. That way they keep the important processes in-house while they outsource services that need more expertise like taxes and auditing.

Wanna Outsource Your Accounting?

If you’re looking into in-house vs outsourced accounting, then you probably are considering outsourcing. Luckily, you’re in just the right place for it! Noraal offers a wide range of financial services that can help your SME grow and thrive in Dubai. All you have to do is contact us today and book a consultation!