If you’re looking to start, or already own, an SME in the UAE, there are many things to take into consideration. But one of the most important decisions you should make is which accounting method you will use. You see, the financial health of your business is key to growth. And choosing the right method can affect how you record your income and expenses, as well as tax filing and financial analysis. So today, we’re gonna have the cash vs accrual accounting breakdown. From the differences to the pros and cons, let’s go over it all so you can make an informed decision!

Cash vs Accrual Accounting - The Full Breakdown

What Is Cash Accounting?

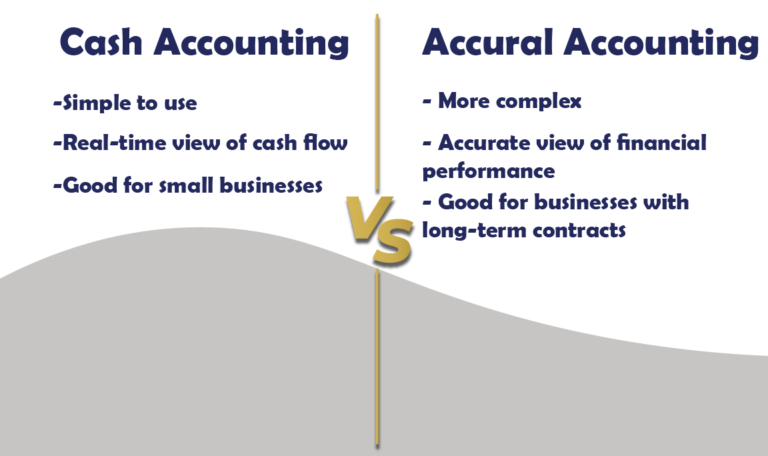

Basically, cash accounting is a pretty straightforward method. Transactions are recorded only when money is actually exchanged. In other words, when you receive money, you record it as income. And when you pay money, you record it as expenses. It is a good method for companies that are just starting out because they reflect real-time cash flow.

However, in its simplicity, it can be misleading when doing profit assessments. You see, cash accounting doesn’t show accounts receivable/payable. So if your company is bigger or has a lot of inventory, it might not be your best option.

What Is Accrual Accounting?

On the flipside, accrual accounting is about recording transactions when they happen, regardless of when the cash actually gets paid. This method can provide a more accurate view of a company’s financial performance. And it is good for businesses with long-term contracts and inventory.

Now, taking all those things into consideration makes accrual accounting more complex than cash accounting. Moreover, it doesn’t track real-time cash flow since it doesn’t take into consideration the actual time of cash exchange. Finally, being more complex, this method requires accounting software programs to keep track of it.

So, Which Is the Better Method?

In reality, there is no right or wrong, better or worse method when it comes to cash vs accrual accounting. However, there is a better fit for your business and the region your operate in. For example, in the UAE, businesses are free to choose. But accrual accounting is preferable because the accounting standard is the IFRS. And under that standard, the accrual method is generally required!

Now, if you wanna avoid all the hassle of choosing the right method and doing all the accounting, we got you. At Noraal, our certified accountants can handle all your company’s accounting needs from A to Z. Not only that, but we provide a range of financial services that we tailor specifically for your business! That way, you don’t have to worry about the details and have the time and resources to focus on what matters: your growth. So, contact us today for a free consultation if you’re ready to take your business to the next level!