In today’s world, businesses are quickly evolving, and financial management is a need. It ensures financial growth and profits. However, if it’s a startup or SME in question, the company probably can’t afford to hire a CFO. So, this is where CFO consulting becomes a must and is actually the best solution! That’s why we’re gonna take a look at what they offer, who needs the consultants, and how to choose the right firm. Now, let’s jump right into it, shall we?

What Do CFO Consultants Do?

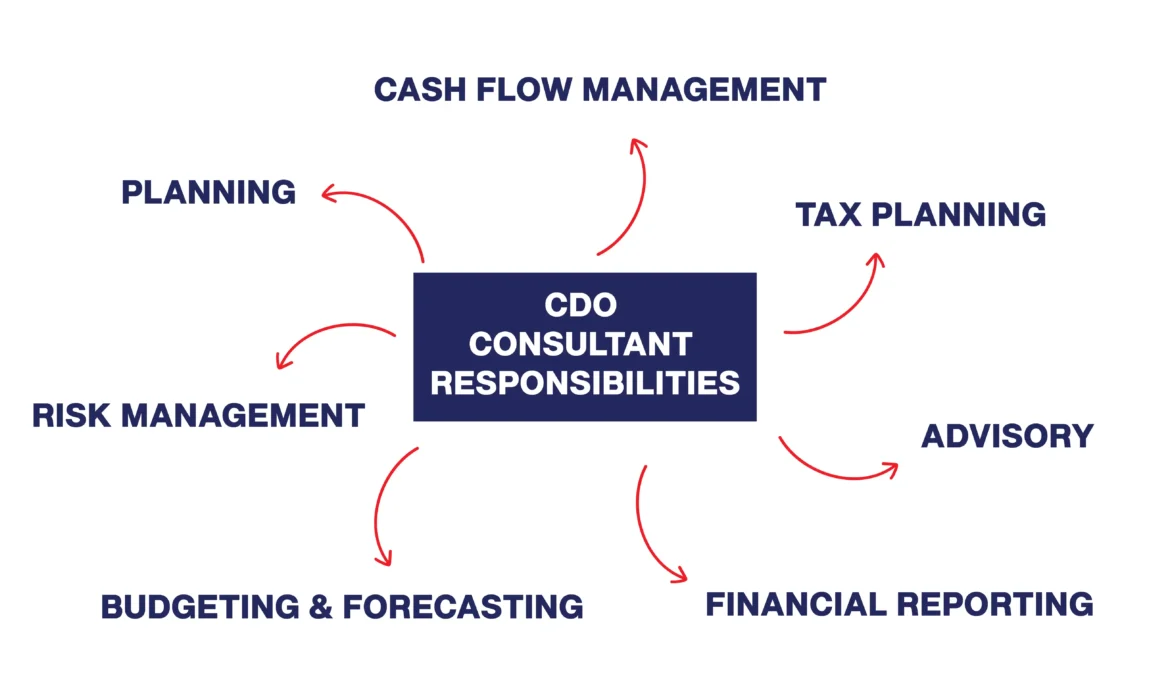

So, CFO consultants are financial experts who offer services like CFO advisory, financial planning, etc… All that happens on a contract or part-time basis since these consultants are not really employees. They provide experience and financial insights without the need for an actual CFO in the company. Now, CFO consultants offer a wide range of services like the following:

- Financial Planning and Strategies: CFO consulting provides plans for the future of a company to sustainably grow and make profit.

- Budgeting and Forecasts: Here, we can expect CFO consultants to forecast the financial status of a company and its budget. This helps the business make financially sound decisions.

- Cash Flow Management: You don’t want your business to hit a wall when it comes to liquidity and cash availability. Hence, a CFO consultant can manage cash flow, what goes in and out, to ensure this doesn’t happen.

- Tax Planning and Compliance: Proper tax planning and compliance with tax laws is a must to avoid penalties. Hence, CFO consulting can do it for you and save you the trouble.

- Financials Reporting and Analysis: CFO consultants can present insights based on the analysis of a business’ financial statements. This can help the company make better decisions in the future.

- Risk Management: Every business has industry specific risks and challenges. A CFO consultant’s job is to identify them and provide solutions that businesses can implement.

- Investment Advisory: CFO consulting can offer advice on how to manage investments and raise capital successfully.

Why Do Companies Need CFO Consulting?

First off, CFO consulting can save your company the money you would spend by hiring a full-time CEO. Second, these consultants have experience in this specific domain, and have the ability to provide unbiased insights. This helps companies improve their financial health and the efficiency of the financial processes. Finally, by hiring CFO consultants, you can scale the service to match the growth of your company! So all in all, outsourcing this service can certainly be beneficial to your business in many ways.

How to Choose the Right Firm

If you’re looking for a firm to provide CFO services, the options are naturally endless. So, there should be criteria based on which you can choose the right firm for your business. Here are the most important factors to consider:

- Industry Experience: Choose a firm that has experience in the specific industry your company operates in.

- Success & Reviews: You should check what previous (and current) customers say about the firm and how historically successful it is.

- Cost: Of course, you’re outsourcing to relatively save what you would pay for a full-time CFO. So make sure that the CFO consulting service aligns with your company’s budget.

- Availability: A good CFO consultant should meet your business’ needs on demand.

- Communication: CFO consulting should make it easy for your company to understand what they have to say. So, successful communication means that they can turn their analysis into an action plan.

Noraal Is Here to Provide Expert CFO Consulting Services!

As we all can agree now, a CFO consulting service can be a game-changer for your business. And at Noraal, we offer tailored services that will help you achieve growth and successfully implement financial strategies. Our team of experts is always ready to bring their experience to help your company grow and stay on track. So, contact us today if you’re ready to take your business to the next level!