Wherever you are in the world, taxes are unavoidable for businesses and individuals. Now, if you own a company, there are corporate taxes that should be paid based on the revenues your company makes. So today, we’re gonna talk about Corporate Tax in UAE. From what it is to who it applies to, we’re gonna cover all the bases, and then some more! So, let’s get started and talk taxation, shall we?

What Is Corporate Tax?

Corporate Tax is basically a direct tax that governments impose on taxable income of corporations and businesses. You can also refer to corporate tax as ‘Corporate Income Tax’ or ‘Business Profits Tax’. Every country has its own set of tax laws and regulations. But now, we’re gonna talk about the corporate tax in UAE!

Corporate Tax in UAE - Basic Guidelines for Beginners

Nobody likes to talk about taxes, tax reports, and the money side of businesses, but somebody has to! So, we decided to make it as simple as we could for those who are just starting out in the business world. If you’re already familiar with the whole game, you can skip to the end where you’ll find a helping hand!

So, on December 9, 2022, the UAE issued its Corporate Tax law, which became effective as of June 1, 2023. This move was the first of its kind in the UAE, but don’t let it put you off since the rates are relatively on the lower end.

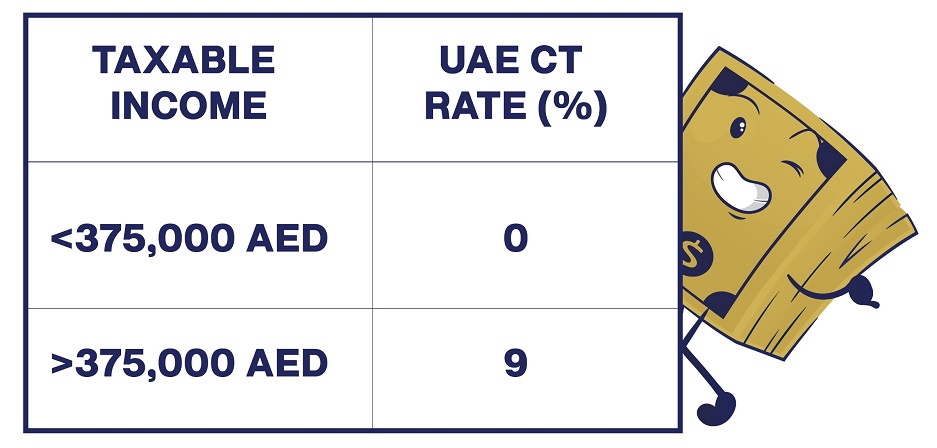

UAE CT Rate

Simply put, if your company’s taxable income is anything under 375,000 AED, you don’t have to pay the tax. Yet if you make more than that, the rate is 9%. This tax applies to all residents and non-resident in the UAE, but each has their own application. Moreover, there are exemptions that can take place. You can check out the Ministry of Finance’s guide on Corporate Tax to know which businesses are exempt and more.

Now, taxable persons, as we already mentioned, could be resident or non-resident. A resident person is taxed on income that comes domestically or from foreign sources. Meanwhile, a non-resident person is only taxed on income generated from within the UAE.

Wanna Avoid the Hassle of Corporate Tax in UAE?

We understand how easy it is to get lost in tax laws and more. So, if you wanna avoid the whole ordeal, you can simply hire external services to handle your tax calculation, filing, and so on. And you don’t have to look too far to find the best service for you. Noraal can handle everything for you, from VAT management to international tax services, we make it easy, simple, and hassle-free! But that’s not all we have to offer. You see, if you need help with your accounting or auditing, we have your back. So, make sure you check it all out and get ready to elevate your company’s financial game!