In the business world, accounting is a must to ensure accuracy and reliability on the financial level. And to make sure that this happens, you need a solid accounting system to be in place! That’s why today, we’re gonna talk about one of the most common systems: double-entry accounting! You see, understanding this system will make operations run smoothly, and ensure transparency. Moreover, it will prevent your company from making unnecessary accounting mistakes! So, let’s find out what this is all about and how it can help your business.

What Is Double-Entry Accounting?

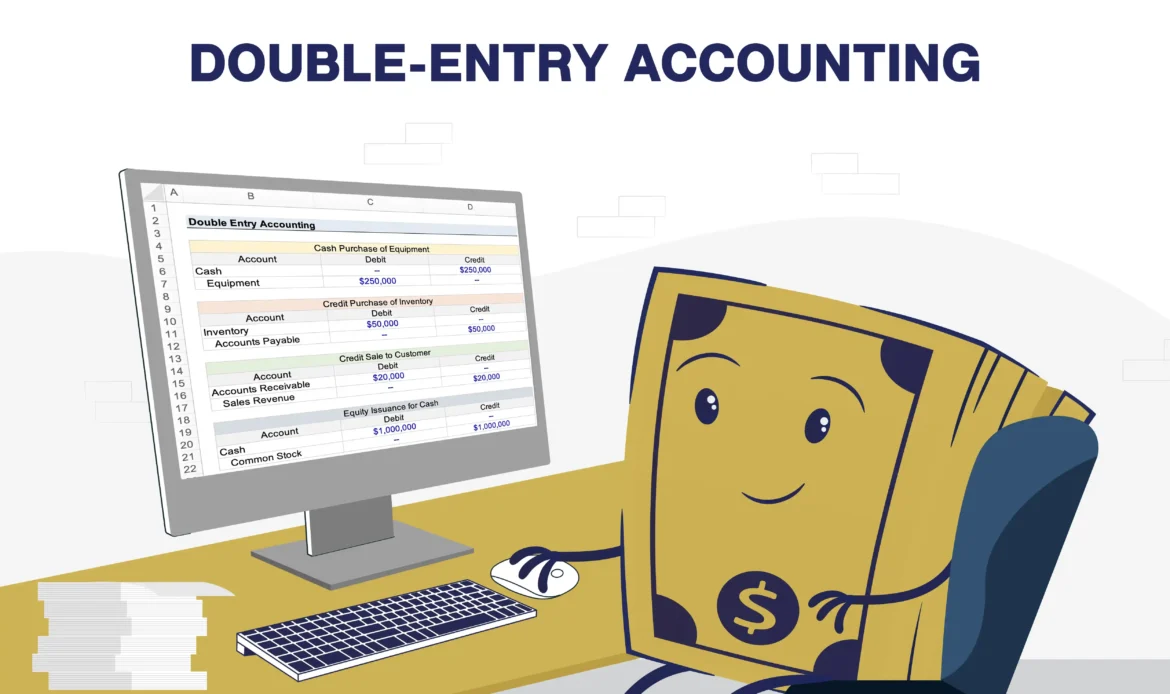

Basically, double-entry accounting is a system where you record every financial transaction, and each one affects two types of accounts. You see, every transaction is split into debit and credit, where the value of both is equal. This ensures that the equation remains balanced. This helps businesses maintain accuracy in their financial records as well as keep an eye on their financial health.

Principles of Double-Entry Accounting

First, as we mentioned, each transaction affects two accounts. And accounts are generally classified into five categories:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

You can read more about these five types of accounts right here.

Second, the debited amount of money must be equal to the credited amount to make sure that the books are balanced. Finally, this all leads to the maintenance of the accounting equation where every transaction leads to an increase/decrease in assets, liabilities, or equity.

Benefits of This System for Businesses in UAE

- Accuracy and Fraud Prevention: When transactions are clearly recorded in two accounts, accountants can spot errors and correct them easily. Moreover, this kind of clarity makes committing fraud much harder.

- Compliance with Financial Regulations: The UAE follows the IFRS accounting standard. And double-entry accounting ensures compliance with this standard as well as corporate tax laws.

- Better Decision Making: Clear bookkeeping leads to creating accurate financial statements. And this helps businesses make better financial decisions based on objective results.

- Investor and Shareholder Confidence: As we previously discussed, accurate accounting leads to financial transparency. And this makes it easier for external auditors to track the financial record. This, in turn, leads to earning the confidence of investors and might even attract new ones!

Need Someone to Handle Your Accounting?

Well, you’re in the right place! At Noraal, accounting and bookkeeping services are our specialties. Not only do we provide double-entry accounting, but we can offer tailored solutions for your business! Whether you’re starting from scratch or pivoting, we have just the thing for you. From auditing to tax and VAT filing, we can help SMEs in the UAE with all the financial weight. That way, you can focus on what matters the most: growth! So, contact us today to book a consultation, and you’ll never have to look back again!