Whenever we talk about the financial side of things, accounting decisions are some of the biggest decisions you will have to make as an owner. And proper tracking and reviewing of financial records is key to successful operations. But knowing when to do your accounting is almost equally as important as actually doing them. So today, we’re gonna discuss monthly vs yearly accounting, and which is better for your business! But before we do, you should know the basic steps of accounting. If you already know the basics, let’s jump in!

What Is Monthly Accounting?

As the name suggests, monthly accounting is all about doing your bookkeeping and financial statements on a monthly basis. This usually happens at the end of the month. The records in question are financial statements, cash flow reports, balance sheets, and more. And whenever we’re debating the monthly vs year accounting, we gotta mention the benefits of monthly record keeping.

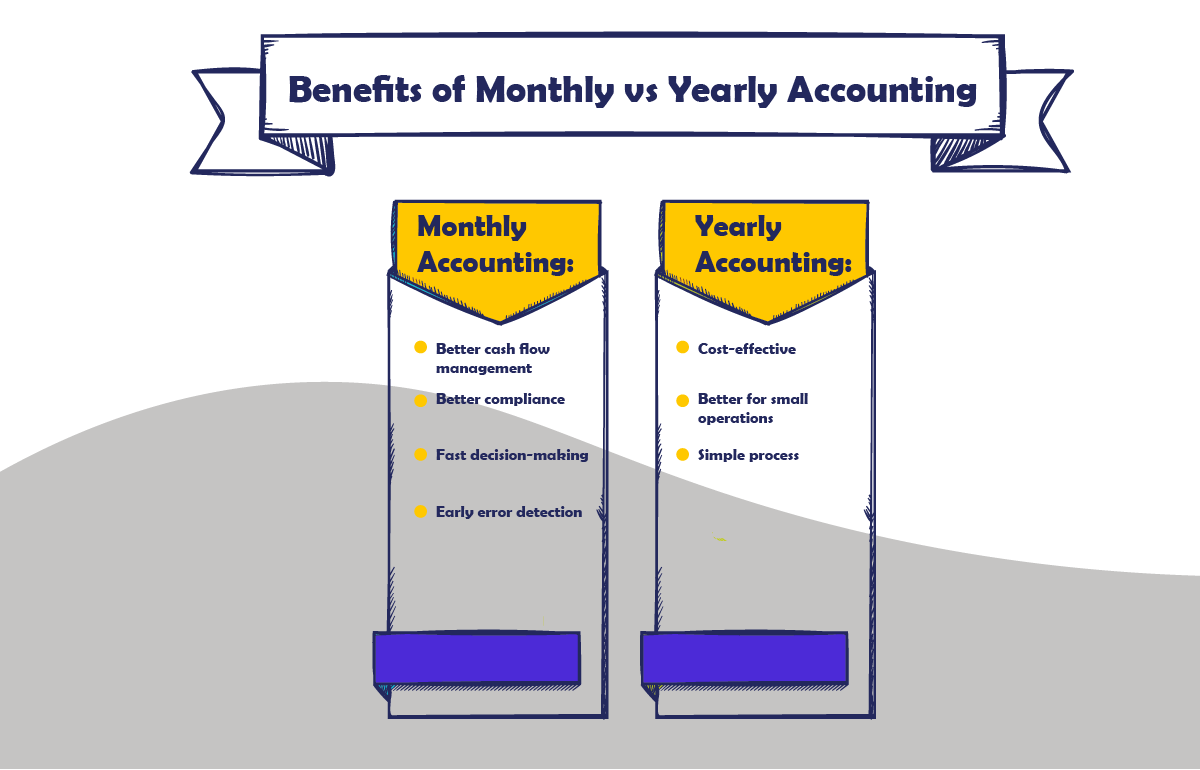

First, it ensures better cash flow management since you’re keeping a close eye on cash shortages and surpluses. Second, monthly accounting can help companies make decisions faster and easily. Third, frequent record keeping makes companies ready for any compliance check. And even, the process makes VAT and general tax filing much smoother. Last but not least, monthly records can help businesses catch errors and discrepancies early on.

What Is Yearly Accounting?

Basically, yearly accounting means that companies will do their recording and analysis once a year. This usually happens at the end of the fiscal year, so not necessarily by the end of the calendar year. And in the monthly vs yearly accounting talk, annual accounting is usually needed for tax filing, compliance insurance, and to report to shareholders. Now, what are the benefits of this type of accounting?

Conducting your accounting operations on a yearly basis is cost-effective. In other words, it will cost you less in accounting fees. Moreover, sometimes you don’t even need monthly accounting. This is especially true in the case of small businesses/startups, freelancers, or companies that are VAT-free.

Monthly vs Yearly Accounting - A Quick Comparison

We already discussed the pros of both types of accounting, and now it’s time to include the cons too. While monthly accounting is useful for SMEs that need to keep up with Dubai’s fast-changing business environment, it can be on the costly side. However, monthly accounting does provide the value you’re paying for. Meanwhile, yearly accounting can be less costly, but you will be compromising other parts of the process.

For example, waiting for a whole year to close your books might lead to finding errors that could’ve been avoided early on. This can also lead to making compliance assurance a bit harder. But, if you’re a small business who doesn’t have to worry about that, yearly accounting is the simpler option!

Noraal Can Help With the Monthly vs Yearly Accounting Debate!

In the UAE, VAT compliance and proper accounting are crucial. And if you’re back at the monthly vs yearly accounting question, you don’t really have to. You see, Noraal is here to make all your finances go as smoothly as ever! From accounting to bookkeeping, auditing, and much more, we’ve got your back. And whether you wanna prepare monthly records or end-of-year statements, that’s our job. So, make sure you contact us today for a free consultation, and you will never have to look back again!a