Every business venture in the world starts with the intent to become valuable in the business world. But nothing speaks of how valuable a business is like money! And well, today, we’re gonna talk about how to put a monetary number on companies. So, we’re gonna check out different business valuation methods and their approaches. But before we do, make sure you check out our blog for some extra financial education! Now, let’s hop in, shall we?

What Is Business Valuation? And Why Does It Matter?

So, business valuation is the process of putting a dollar value to a company. Business valuation is an essential part of a company’s financial assessment. This is especially important for businesses in case there’s a merger, fundraiser, inquiry, or any sort of big transaction. Now, business valuation methods can vary depending on the industry and the type of company.

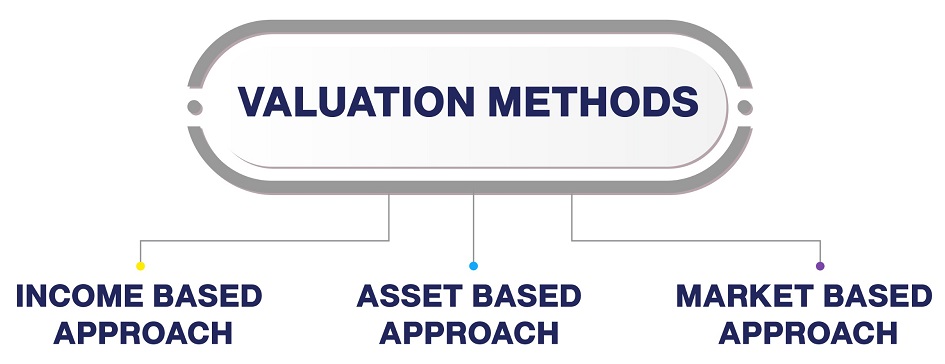

Types of Business Valuation Methods

There are multiple types of business valuation methods, and each group falls under a category of approaches. Oh, and keep in mind that you can use those methods individually or combine them! This all depends on the preference of the person doing the valuation.

Income-Based Approach

So, an income approach is all about the future. The methods under this category calculate a company’s worth based on how much income it can generate in the future. They take into consideration the company’s ability to make profit over time and reach the current value using that. The Income-based approach includes methods like Discounted Cash Flow (DCF), capitalization of earnings, income multiplier, and more. But don’t worry, we’re gonna cover all of those in detail later on!

Asset-Based Approach

Next up, we have the asset approach which determines a company’s value using the value of its net assets. This can generally happen by subtracting the value of liabilities from the value of the assets of the company. Some of the methods in this approach are the liquidation value, book value, and replacement cost.

Market-Based Approach

The third approach that you can use for a business valuation is the market approach. Here, it’s all about estimating the value of the company based on market metrics. For example, you can compare your company to other similar companies to estimate its value. Some of the business valuation methods that fall under the market approach are market capitalization, comparable company analysis (CCA), etc… There are also ratios and equations that you can use here which we will cover later!

Wanna Save Yourself the Company Valuation Trouble?

If you don’t wanna get into all this hassle, there are always external services that you can hire. Luckily, you don’t have to look too far, because Noraal is here for you to do the valuation. We deliver precise valuations that are a combination of in-depth studies and financial experience. But that’s not the only thing we have to offer! So, go on and check out Noraal’s wide range of financial services before you need them next. Good luck!